Here’s How Taxes Are Affected by Maternity, Parental, or Adoption Leave

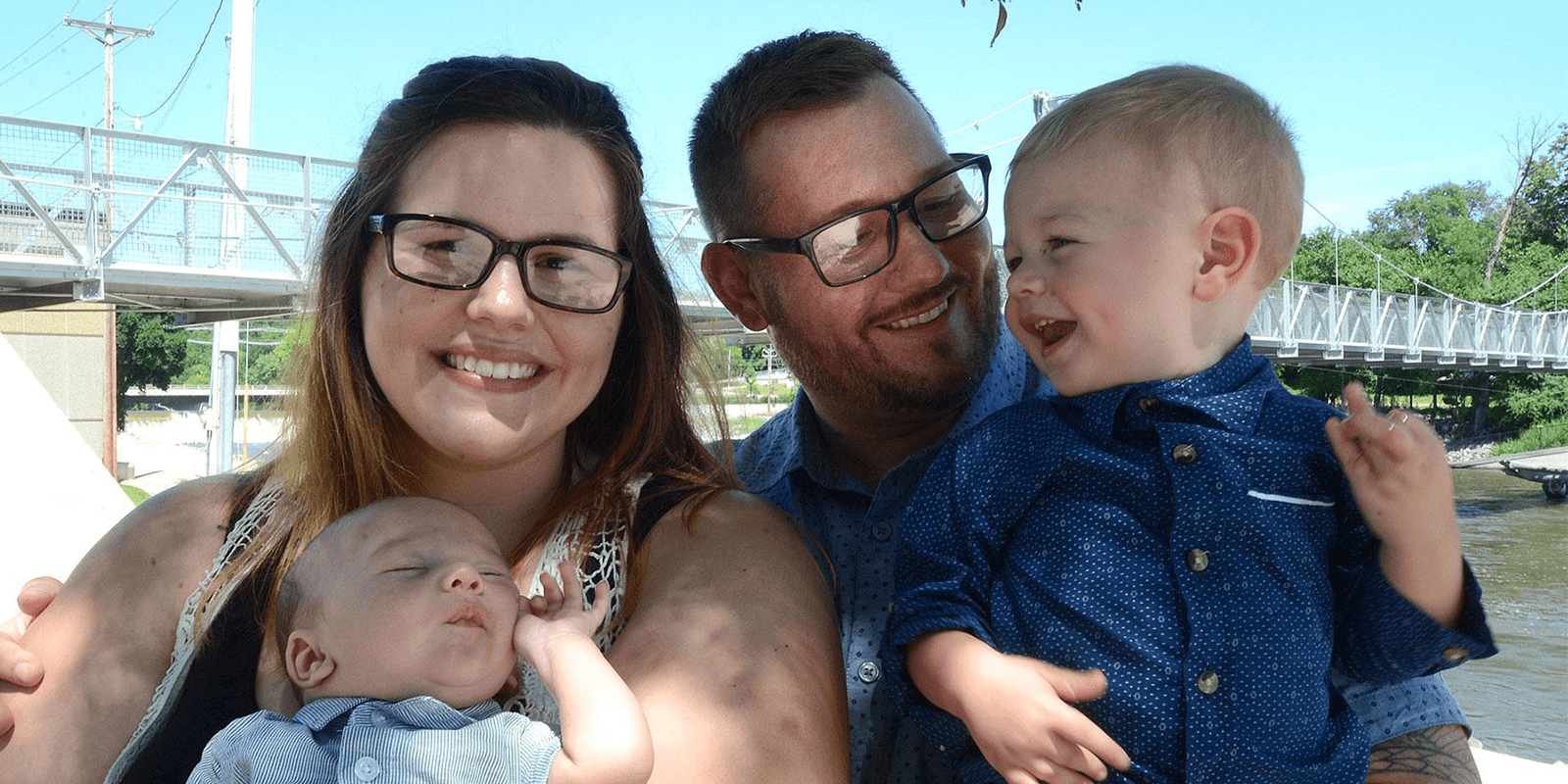

Whether you have a little one on the way, recently welcomed a new baby into your home, or are in the process of adopting, the anticipation of this significant change is undoubtedly exciting for parental leave. As you embark on the journey of parenting, it’s important to recognize that your income and tax situation will undergo certain adjustments. While it may not be your primary focus at the moment, familiarizing yourself with the support available during maternity, parental, or adoption leave can save you time and hassle in the future. To assist you, we’ve compiled answers to common questions our Tax Experts receive regarding how becoming a parent impacts your taxes.

Planning Parental Leave? Here’s How It Impacts Your Taxes.

If you’re considering taking time off work when your baby arrives, you might wonder if you’re eligible for Employment Insurance (EI) benefits. Generally, to qualify for parental leave benefits, you need to have worked 600 insurable hours in the previous year before making a claim.

Now, if you’re receiving EI benefits during your time off, it’s important to note that they are taxable. Any money received from EI is considered income and must be reported on your tax return. While EI typically withholds less than 10% for tax purposes, the lowest federal tax rate is 15%, which can result in a tax bill for new parents when filing their tax return, depending on the timing of the leave. It’s wise to be prepared for a potential tax bill or set aside a portion of your maternity/parental/adoption leave benefits to cover taxes owed in April.

Are there any other federal benefits you might be eligible for?

Most Canadian resident parents can apply for the Canada Child Benefit (CCB). Usually, hospitals have a registration system that automatically notifies the Canada Revenue Agency (CRA) when a baby is born. However, if this didn’t occur or your situation is different, you can download and submit Form RC66 to the CRA for your new baby. The CCB amount depends on your net family income and the number of children you have. The benefit is tax-free, meaning you don’t have to pay taxes on the amount you receive.

If you have another child or if your child is in daycare, you may wonder if you can deduct these expenses while receiving EI benefits. While childcare expenses are still tax-deductible, you cannot deduct them from your parental leave income. It’s important to note that these expenses should be claimed by the lower-income spouse, typically the parent on leave. Your ability to claim childcare expenses may depend on the timing of your leave and whether you have other employment income during the tax year.

Unmarried couples living together with a child are also eligible for the same benefits as married couples. For tax purposes, once children are involved, your marital status is considered common-law, and benefits are calculated for your household in the same manner.

Becoming a parent is a monumental life change, and it’s natural to feel uncertain about what to expect. Children always keep us guessing! To ease your tax-related concerns, it’s advisable to keep track of your documents and minimize any guesswork when it comes to filing your taxes.

Welcoming a new addition to the family is an exciting and joyous event, but it often comes with significant financial adjustments. One aspect that new parents should consider is the potential shift in taxes during parental leave. In this blog post, we’ll explore how taxes can change during parental leave and provide valuable insights into managing your finances effectively during this crucial time.

Also Read: Are tipping subject to taxation in Canada?

Understanding the Basics

Before delving into the specifics of how taxes can shift during parental leave, let’s review some fundamental concepts:

- Income During Leave: During parental leave, your income may change. Some employers offer paid parental leave, while others do not. In some cases, you may rely on short-term disability benefits, state programs, or personal savings to cover expenses during your time away from work.

- Tax-Advantaged Benefits: Many employers offer tax-advantaged benefits such as health savings accounts (HSAs) and flexible spending accounts (FSAs) that can help you manage healthcare expenses for both yourself and your child.

- Tax Credits: There are several tax credits and deductions available to parents, such as the Child Tax Credit and the Child and Dependent Care Credit, which can help reduce your overall tax liability.

How Taxes Can Shift During Parental Leave

- Changes in Taxable Income: If your income during parental leave is lower than your regular salary, your tax liability may decrease. This is because your federal and state income tax obligations are often based on your taxable income. Be sure to adjust your withholding or estimated tax payments accordingly to avoid overpaying taxes during this period.

- Tax Credits and Deductions: As a new parent, you may become eligible for tax credits and deductions that were not available to you before. For example, the Child Tax Credit can provide a significant reduction in your federal income tax liability if you have a qualifying child.

- Employer Benefits: Review the benefits offered by your employer during parental leave. Some employers continue to provide certain benefits, such as health insurance and retirement contributions, even when you are not actively working. Understanding these benefits can help you make informed decisions about your financial planning.

- State Tax Laws: Be aware that state tax laws regarding parental leave and tax credits can vary. Research the specific tax regulations in your state to ensure you are taking advantage of all available benefits.

Financial Planning During Parental Leave

To navigate the potential shifts in taxes during parental leave, consider these practical financial planning steps:

- Review Your Budget: Adjust your budget to accommodate changes in income and expenses during parental leave. Prioritize essential expenses and create a savings plan to cover any gaps in income.

- Consult with a Tax Professional: A tax professional can help you navigate the complex tax implications of parental leave, ensuring you take full advantage of available credits and deductions.

- Explore Employer Benefits: Understand the benefits your employer offers during parental leave, including healthcare coverage, retirement contributions, and any available paid leave programs.

- Update Your Withholding: If your income will be significantly lower during parental leave, consider updating your tax withholding to reflect your reduced income. This can prevent overpayment of taxes.

Also Read: Are Gifts To Customers And Business Associates Deductible Expenses?

Conclusion

Parental leave is a transformative time in your life, and understanding how taxes can shift during this period is essential for effective financial planning. By staying informed about changes in taxable income, available tax credits, and employer benefits, you can make informed decisions to manage your finances while enjoying the precious moments with your new child. Consult with financial professionals or tax experts to ensure you are optimizing your tax situation and maximizing available benefits.

Recent Posts

FAQ

Are unmarried couples living together with a child eligible for the same benefits as married couples?

Yes, for tax purposes, once children are involved, your marital status is considered common-law. Consequently, unmarried couples living together with a child are entitled to the same benefits as married couples. Benefits are calculated for your household in the same manner, ensuring fairness and equal treatment.